Calculate 401k contribution percentage

Held an approximate 65 trillion in retirement assets according to the Investment Company Institute. Annual SIMPLE IRA Contributions.

After Tax 401 K Contributions Retirement Benefits Fidelity

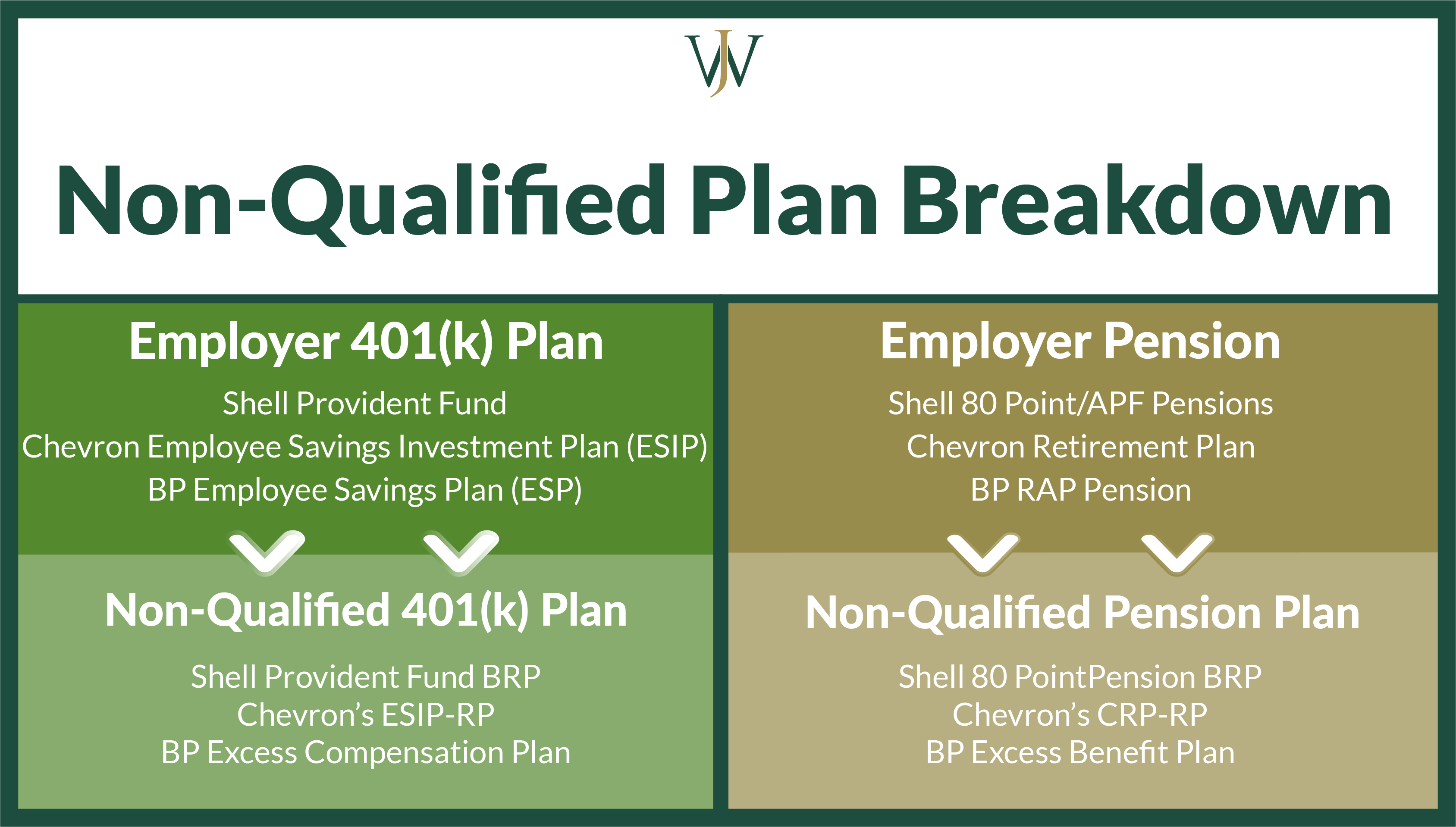

Pensions also known as Defined Benefit plans have become rarer as companies force their employees to save for themselves mainly through a 401k 457 403b Roth 401k or IRA.

. How Income Taxes Are Calculated. First we calculate your adjusted gross income AGI by taking your total household income and reducing it by certain items such as contributions to your 401k. 2 nonelective contribution - 2 of each eligible employees compensation regardless of whether or how much the employee deferred or.

We automatically distribute your savings optimally among different retirement accounts. If you take a. A profit-sharing plan may include a 401k.

When you invest a lump sum of money calculating the average annual return is simple. May reduce the 3 limit to a lower percentage but in any event not lower. These savings vehicles are also known as Defined Contribution plans.

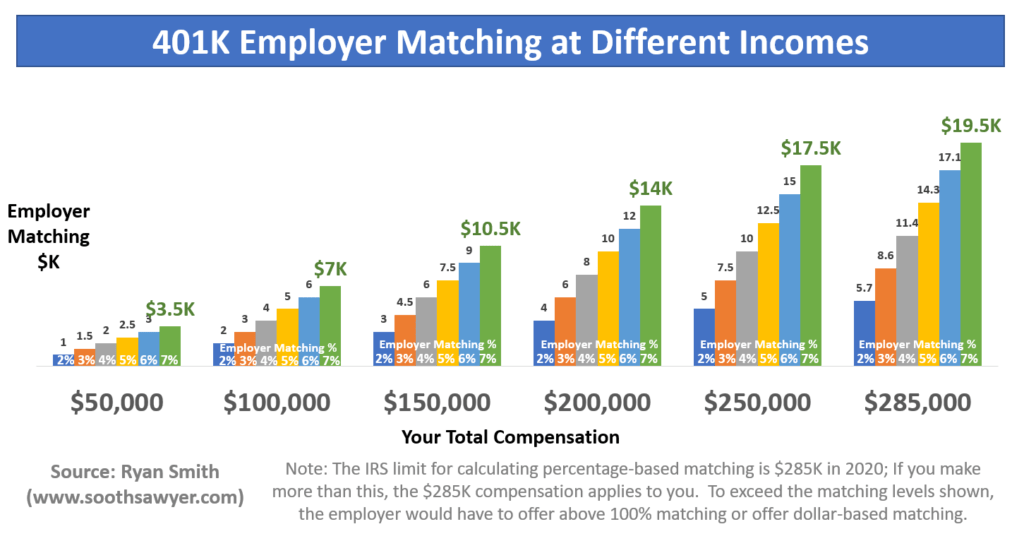

When two or more companies with common ownership meet the IRS controlled group definition they are considered a single employer for 401k plan purposes. Your employers 50 match is limited to the first 6 of your salary then limits your employers contribution to 3000 on a 100000 salary. Most 401k administrators automatically invest your money into a target-date fundTarget date funds are portfolios of various mutual funds and investments tailored to your estimated retirement date.

That means everyone pays a percentage of their income to the federal government but higher-income filers pay a higher percentage. SIMPLE IRA contributions should be at least 3 percent of annual compensation or 5000If theyre more than 20000 or 8 percent to 10 percent of your employee income it may be better to use. If you only contribute 3 your contribution will be 3000 and your employers 50 match will be 1500 for a total of 4500.

If you made an excess contribution to your 401k heres what to do and when to get your 401k overcontribution fixed in time to avoid a tax headache. So if your annual salary is 100000 and you use the 75 replacement rate as a starting point you will need to earn 75000 from various retirement resources such as 401k accounts part-time. Determine your elective contribution percentage.

But did you know that paying off your student loans quickly could possibly. We assume that the contribution limits for your retirement accounts increase with inflation. Basic match - 100 on the first 3 of compensation plus a 50 match on deferrals between 3 and 5 4 total.

You may elect to defer any amount of your salary as a 401k contribution up to the annual limit established by the IRS. You should notify the employee that the excess contribution is not eligible for favorable tax-free rollover. Check Every Corner of Your 401k Once you gain access to your account online or review your statement check how your money is invested.

These contributions must be the same percentage for each participant. We stop the analysis there regardless of your spouses age. If your employer offers a 401k plan consider contributing pre-tax money with every paycheck.

An employer-sponsored 401k retirement. This post will help you calculate the value of a pension. How to calculate your SEP IRA contribution If you pay yourself a salary using a IRS W-2 form then calculating your maximum allowed SEP IRA contribution is easy.

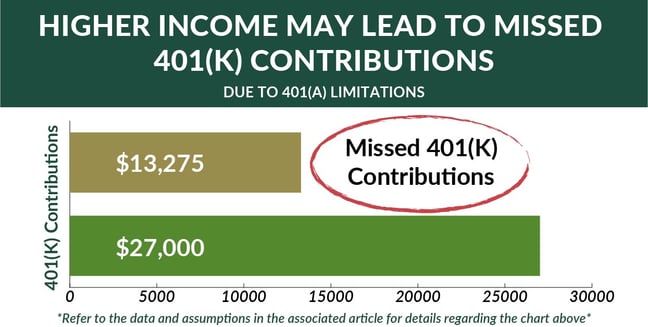

If you are more than 50 years old you can make an additional catch-up contribution of 6500 for a total of 27000. Your taxable income is 39650 51200 salary 1500 401k contribution 2500 in other income 12550 standard. 1 At least five years must have elapsed from the first day of the year of your initial contribution and 2 You must have reached age 59½ or become disabled or deceased.

As of 2020 the 401k contribution limit for those aged 50 and below is 19500. If you are paying an advisor a percentage of your assets you are paying 5-10x too much. There are a number of retirement accounts that allow you to save and invest toward your retirement goals but one of the most common in the US.

On Wednesday April 6 2022 the US. Some rules of thumb for reading the SIMPLE IRA contribution calculator results include. If youre 50 or older you can make an additional catch-up contribution of 6000.

For a matching contribution to meet safe harbor 401k requirements it must use one of the following three formulas. The Roth 401k contribution limits are cumulative with your traditional 401k contributions and cannot exceed 19000 as of 2019. How to calculate a 401k annual return.

Contribute to your 401k. For most people the maximum contribution to a 401k plan is 20500 in 2022. 3 matching contribution - match of employees elective deferrals on a dollar-for-dollar basis up to 3 of the employees compensation.

When you have a student loan balance we understand you want to get rid of your student loan as soon as possible. Some employers even offer contribution matching. So normally we would be able to calculate.

The plan contains a formula for allocating to each participant a portion of each annual contribution. Profit-Sharing Plan is a defined contribution plan under which the plan may provide or the employer may determine annually how much will be contributed to the plan out of profits or otherwise. If you increase your contribution to 10 you will contribute 10000.

401k plans must often benefit the employees of all controlled group members to pass the IRC section 410b coverage test annually. 2021-30 Appendix B Section 20. Footnote 1 Any earnings on Roth 401k contributions can generally be withdrawn tax-free if you meet the two requirements for a qualified distribution.

As of September 2020 401k plans in the US. Method 2 one-to-one method under Rev. Learn how to find an independent advisor pay for advice and only the advice.

But since you make regular contributions to your 401k you cant. Try to meet or exceed their matching amount to make the most of your retirement savings. Excess contributions adjusted for earnings are assigned and distributed to the HCEs.

For a 401k plan to achieve safe harbor status the employer must make a qualifying contribution to eligible employees. Put differently - overlooking a member can often mean a failed coverage test. As of the time of publication the annual contribution limit for most employees is 16500 but most employees select a flat percentage of gross income to contribute each paycheck.

Learn more about how to calculate your federal income tax using rates tables. Department of Education announced an extension of the pause on federal student loan repayment interest and collections through August 31 2022. Many employees are not taking full advantage of their employers matching contributions.

If for example your contribution percentage is so high that you obtain the 20500 year 2022 limit or 27000 year 2022 limit for those 50 years or older in the first few months of the year then you have probably maximized your contribution but minimized your employers matching. Also we separately calculate the federal income taxes you will owe in the 2020 - 2021 filing season based on the Trump Tax Plan. We assume you will live to 95.

For example if youre 55 in 2019 and you contribute 10000 to your traditional 401k you cant contribute more than. How to Read Your SIMPLE IRA Calculator Results. The 2023 contribution limits for 401k403b457 plans and TraditionalRoth IRA will go up substantially due to high inflation.

Customizable 401k Calculator And Retirement Analysis Template

How Much Can I Contribute To My Self Employed 401k Plan

Solo 401k Contribution Limits And Types

How Much Should I Have Saved In My 401k By Age

How Much Should I Have Saved In My 401k By Age

401 K Plan What Is A 401 K And How Does It Work

How To Protect Your Retirement Savings Fidelity Investments Investing Investment Portfolio Saving For Retirement

Corporation Calculating My Solo 401k Contributions For A Corporation My Solo 401k Financial

Tax Impacts Of Non Qualified 401 K Pension Benefits For High Income Earners

Retirement Services 401 K Calculator

Solo 401k Contribution Limits And Types

What Is A 401 K Match Onplane Financial Advisors

Do You Max Out Your 401k Mid Year Stop Immediately Soothsawyer

401 K Income Limits The Mistake Executives Earning Over 305 000 Make All The Time

What Is A 401 K Match Onplane Financial Advisors

Solo 401k Contribution Limits And Types

401 K Calculator See What You Ll Have Saved Dqydj